Welcome to Xeva Ventures

Stop Overpaying Taxes and Save Up to $30K Annually

We help W2 and 1099 professionals, real estate investors, and high-income earners keep more of what they earn using IRS-approved strategies built around your unique goals, not cookie-cutter tax plans.

$9M+

In Tax Savings Recovered

10+ Years

Of Combined Tax Expertise

100%

Legal and IRS-Approved Strategies

Learn More

About Our CEO

Mastering Tax Efficiency with Xeva Ventures

Personalized, done-for-you tax strategies that help high earners keep more of what they make legally and confidently.

Welcome to Xeva Ventures, where we specialize in helping business owners and individuals take control of their financial future through innovative tax strategies and personalized planning.

From tax filing to entity structuring, our strategies are designed to simplify your finances and maximize savings year-round.

Actual Tax Strategists

Why Choose Xeva Ventures

We don’t do cookie-cutter tax plans.

Our team combines deep-dive analysis, entity optimization, and wealth-building strategies to uncover savings most accountants miss.

Every plan we create is tailored for growth, compliance, and lasting financial freedom.

Key Services Offered

What we offer

Tax Strategy

Discover untapped deductions and hidden savings through precision tax mapping, revealing opportunities that traditional firms often overlook.

Entity Formation

We craft bespoke, IRS-compliant structures that balance protection and performance, ensuring your assets and profits are positioned for sustainable growth.

Tax Return Audit

Our specialists perform white-glove audits of past filings to recover missed savings and refine your financial efficiency.

Our Clients

Clients Who Use Xeva Ventures

Our Clients

Client Testimonials

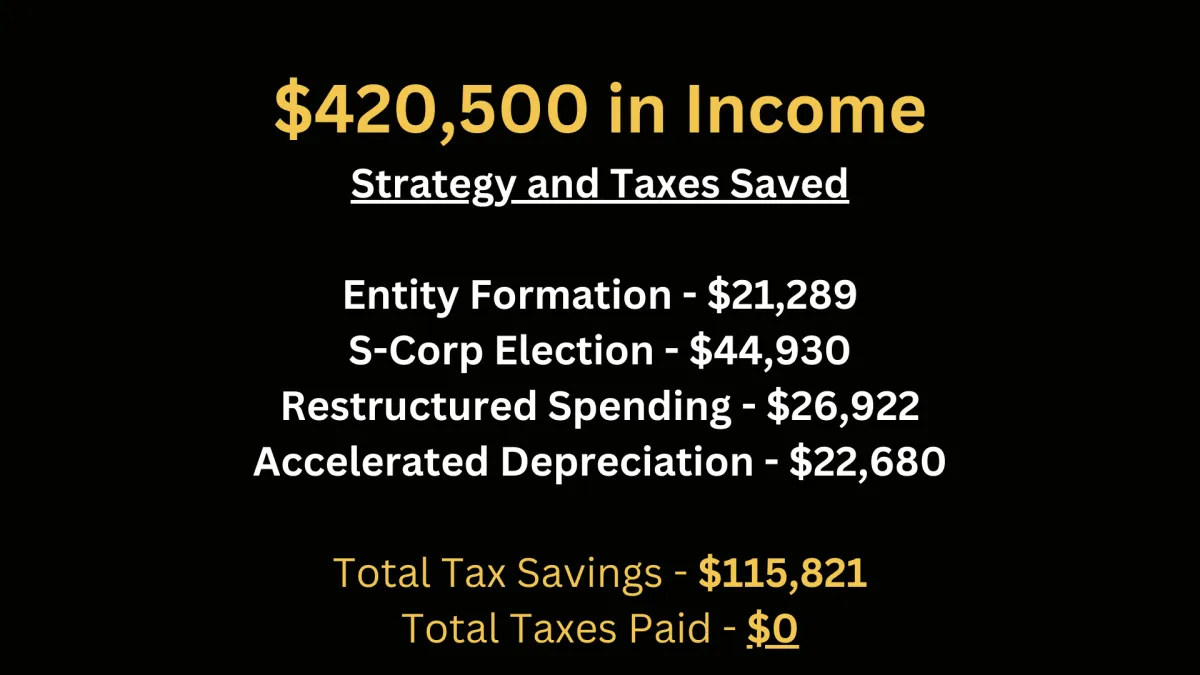

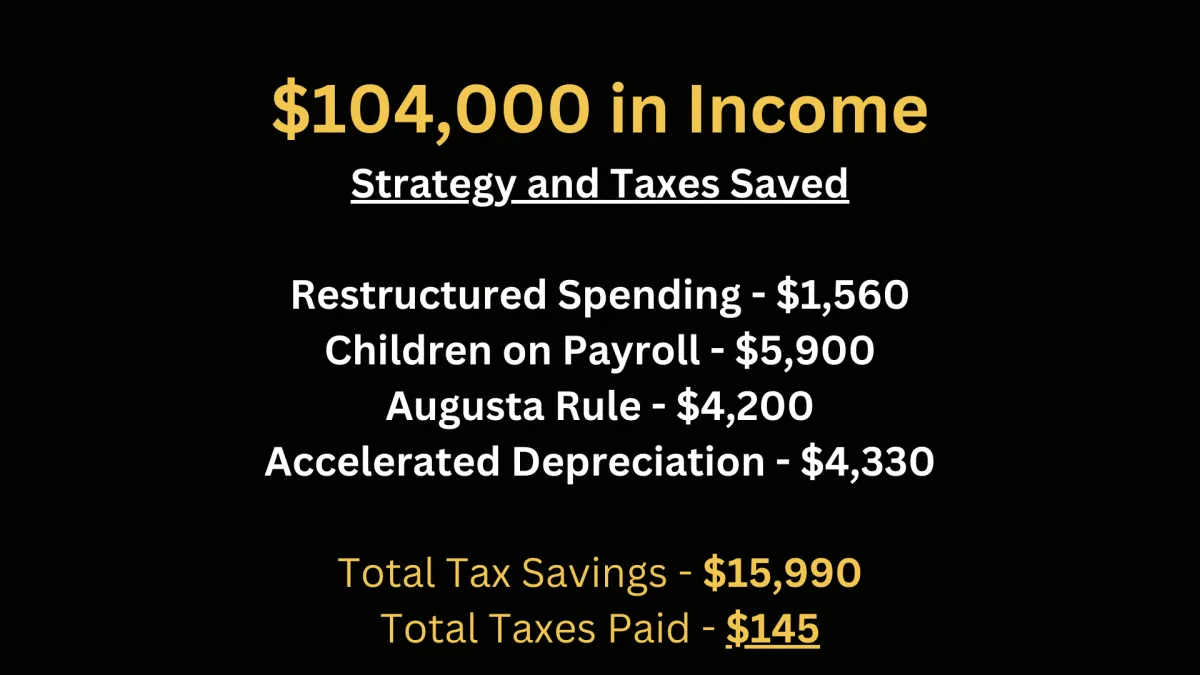

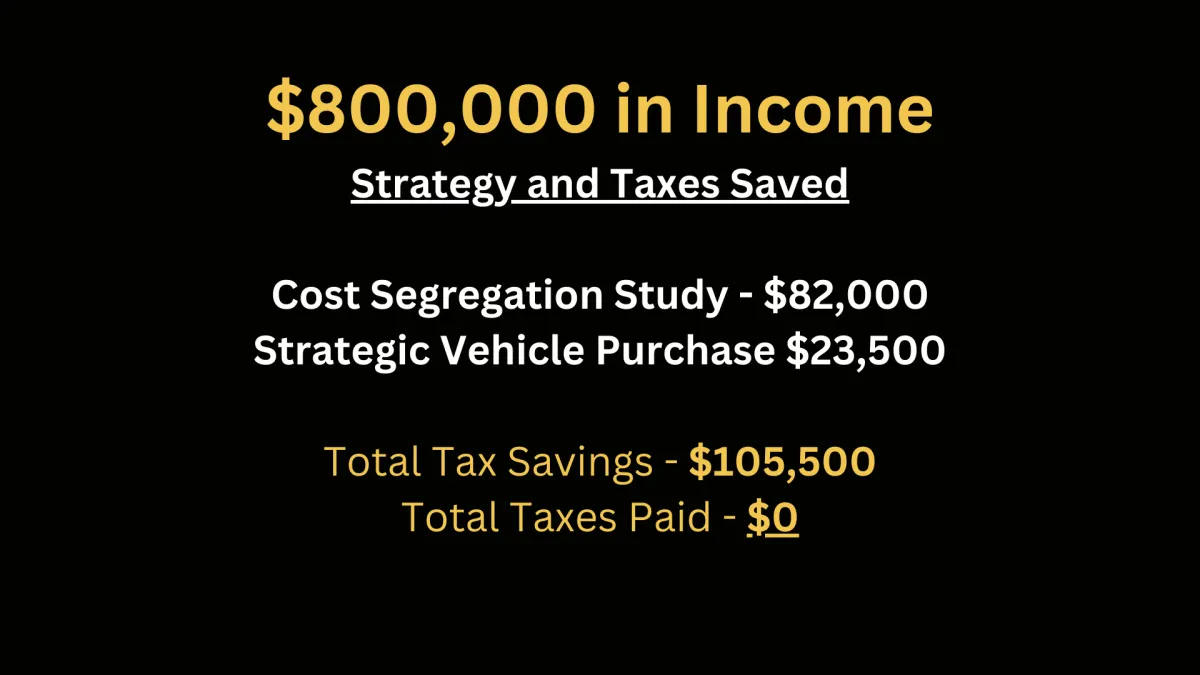

Featured Case Studies

Real Case Studies from Real Clients

Xeva Ventures

Case Study 1 - Alec Smith

Xeva Ventures

Case Study 2 - Evan Lawrence

Xeva Ventures

Case Study 3 - Zac Heninger

How it Works

A Quick Overview of the Process

Tax DNA

Review

The first step is identifying where money is being left on the table.

Read More

The IRS gives taxpayers 3- years to refile taxes, which can include missed opportunities to receive tax refunds. This is where a savvy accountant begins his work, and where we will begin as your tax strategist.

Tax Strategy

Analysis

The #1 mistake we see with clients is they are leaving money on the table from not reviewing and refiling their previous tax returns.

Read More

Without knowing your tax liability, you are in the dark as an entrepreneur on what tax strategies will work to help you. Having an accurate tax analysis will help determine the next steps to eliminate and reduce your income tax.

Advanced Entity Structuring

The #1 mistake we see with clients is they are leaving money on the table from not reviewing and refiling their previous tax returns.

Read More

The opportunity cost of having a professional who does not understand your business or how to properly structure your multiple entities to maximize tax savings, could cost you hundreds of thousands of dollars. Our advanced “entity structuring” process provides you with everything I learned while structuring over 8+ companies as a 7 figure tax professional.

Strategy Implementation

The #1 mistake we see with clients is they are leaving money on the table from not reviewing and refiling their previous tax returns.

Read More

Without proper implementation, the tax plan is a waste. Our job as your tax strategist is to implement the strategies for you that are within our control, while holding you accountable to your task as an entrepreneur to secure the tax savings. Focused execution on tax strategies is how you can scale to high 6-figure or even 7-figure tax savings.

FAQ

Most Popular Questions

Explore our comprehensive Q&A section, designed to address your most pressing tax concerns and provide clarity on how TaxAlchemy can assist you.

FAQ #1 - What makes you different than my current CPA?

A tax strategist is like a coach who helps people plan all year to pay less in taxes by using special parts of the tax rules, like finding hidden ways to save money and making plans for the future.

Tax strategists like myself check on clients often and adjust the plan if things change.

A traditional CPA is more like a helper who works mainly during tax season, looking at what happened last year to make sure taxes are done right and that no rules are broken.

While CPAs may know about ways to save, they won't dig as deep into the tax code for extra savings.

FAQ #2 - How do I know you can save me money?

Great question! Because you're spending money on taxes. We will look directly into your situation and find areas you are missing huge tax savings with money you are already spending currently, or with money that you will continue to spend and we will just funnel it differently.

It's all about mitigating your tax liability without you needing to spend more cash.

FAQ #3 - I haven't filed my taxes for the previous year...is that bad?

No! This is why you need someone like me in your corner so you do not fall behind and incur interest from the IRS.

We will help you stay on track and pay less in taxes.

P.S. - it's actually better for us that you haven't filed previous years because we can now go back and get you even more savings!

P.P.S. - we also go back and get clients who are up to date on their taxes previous year savings!

P.P.P.S. - Book the call, let's save you some taxes.

Contact Xeva Ventures Today

Whether you’re a business owner, investor, or entrepreneur, Xeva Ventures helps you navigate complex tax laws with clarity and confidence. Let’s build a custom strategy that saves you money, protects your assets, and supports your long-term financial freedom.

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

IMPORTANT: Earnings and Legal DisclaimersEarnings and income representations made by Travis, xevaventures.com, and their advertisers/sponsors (collectively, "Xeva Ventures") are aspirational statements only of your earnings potential. The success of Travis, testimonials and other examples used are exceptional, non-typical results and are not intended to be and are not a guarantee that you or others will achieve the same results. Individual results will always vary and yours will depend entirely on your individual capacity, work ethic, business skills and experience, level of motivation, diligence in applying the methods by Travis, the economy, the normal and unforeseen risks of doing business, and other factors.

The Xeva Ventures Programs, and Travis individually, are not responsible for your actions. You are solely responsible for your own moves and decisions and the evaluation and use of our products and services should be based on your own due diligence. You agree that Xeva Ventures programs are not liable to you in any way for your results in using our products and services. See our Terms & Conditions for our full disclaimer of liability and other restrictions. Xeva Ventures , including Travis personally, may receive compensation for products and services they recommend to you. Travis personally uses the recommended resource unless it states otherwise.

Do you have questions about any of the Xeva Ventures Programs? Are you wondering if the programs will work for you? Send us an email at

[email protected]. We will be happy to discuss your goals and how the Xeva Ventures program may help you.

Privacy Policy | Terms & Conditions

© 2026. Xeva Ventures. All rights reserved.